| |

|

|

|

|

|

| India has been home to all the major EMS companies including Flextronics, Foxconn, Elcoteq, Jabil Circuits, and Sanmina, etc. There are also numerous home-grown EMS companies catering to multiple but niche application segments. Some pertinent growth drivers for India’s EMS industry include:

|

|

|

| |

|

|

Strong and growing domestic demand for mobile phones, medical, consumer, aerospace and automotive electronics. |

|

Increasing demand for telecom infrastructure equipment |

|

Highly talented workforce, especially for design and engineering services with good communication skills. |

|

Inflation and rising costs of doing business in China. |

|

Presence of global EMS majors and their plans for increased investments in India. |

|

More outsourcing of manufacturing by both Indian and global OEMs that are increasingly focusing on R&D and other core competencies. |

Key factors responsible for the evolution and growth of the EMS industry in India are:

|

| 1. |

Low Cost Attraction – Globally India has and is gaining recognition as one of the best low cost destinations for manufacturing. In recent years, with costs rising in neighboring China, India has been able to further its recognition on the cost front. The hourly compensation for Indian workers employed in an electronics manufacturing factory stands below $0.5 even now. In comparison, the hourly compensation for a US worker is between $20 and $22. Even Mexico, one of the early proponents of the EMS industry, pales in comparison to India at $3 per hour. |

| 2. |

Special Economic Zones (SEZ) – India was the first Asian economy to set up an export processing zone (called SEZ in later years) way back in 1965. The 10th and 11th Five Year Plans are incentivizing the creation of more of electronics hardware SEZs in the country. |

| 3. |

Local Consumption Volumes – Being the world’s second most populated country and one with a growing economy, India has been and continues to remain one of the largest consumers of electronics products. The high domestic consumption volumes make it an attractive destination for electronics manufacturing services. Over 60 percent of India’s population is in the age band of 15-40 years; this along with the rising levels of disposable income is creating a huge consumption market in the country.

|

|

Electronics Consumption

The past decade has been remarkable for the Indian electronics industry from a consumption perspective: 18 million mobile phones in 2003 to 172 million units in 2010; shipment of 3 million PCs in 2003 to over 8.2 million in 2010; from a non-existent market in 2003 to a rapidly growing LCD TV market that witnessed sales of 3.5 million units in 2010. The tremendous growth in all segments of electronics has given the industry a key position on the global map. The Indian electronics industry has been growing at a CAGR of over 25 percent in the past 5 years and the major reasons that can be attributed to this growth are:

|

|

GDP growth rates in excess of 8 and 9 percent. |

|

Revival of the global economy following the 2000-01 dotcom bubble burst. |

|

A rapidly expanding middle class with increasing disposable income. |

|

Continual decline in prices of most the electronics goods(a camera mobile that cost over Rs.15,000 five years ago is available for < Rs. 5,000 today). |

|

Presence, expansion and/or entry of all major Electronic OEMs and suppliers into the country creating greater visibility for brands and products. |

|

Steady increase in exports. |

|

Exemption of custom duty on 217 products that come under the ITA-1 items. |

|

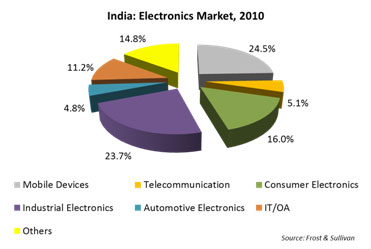

The Indian electronics industry was estimated to be $65.1 billion in 2010 growing at over 27 percent from 2009. Chart 5.1.2.a below presents the contribution of different segments to the Indian electronics industry in 2010.

|

|

|

| |

|

|

|